Gst Question Paper For Bcom

From our GST question paper bank students can download solved previous year question paper. Doing preparation from the previous year question paper helps you to get good marks in exams.

Direct And Indirect Taxation 2018 2019 Bcom Idol Correspondence 3rd Year Tybcom 3 Question Paper With Pdf Download Shaalaa Com

So from today onward I am providing my model question papers to all of you on daily through Whats APP.

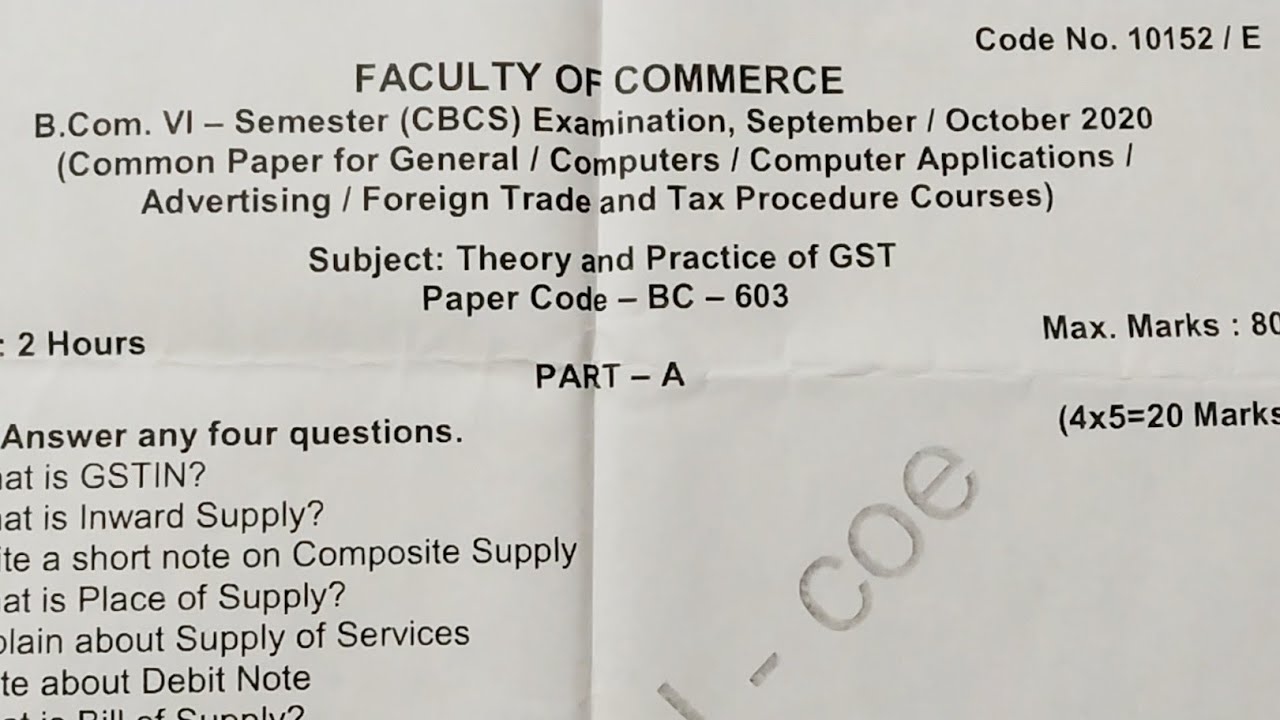

Gst question paper for bcom. A What is dual GST Model. BCom or Bachelor of Commerce is a three-year undergraduate course imparted in regular as well as distance education mode. Income Tax Law and Practice and Income Tax and GST.

A sold goods to Mr. Model question paper for GST practitioner exams 1. E What is Taxable Event under GST.

I Sem Additional English - 1. What is the value in GST invoices when Rs. In second invoice two purchases of Rs 5000 worth goods GST rate 5 and another Rs 5000 GST 18.

Students can check and download the last year 2016-2017 question papers online from the website or from this page through the link is given below. G State any two features of GST Portal. Bcom Question Papers has been published in 2016-2017 and previous year question papers online of BCom.

Management Concept And Business Ethics. BCom Income Tax Law and Practice Previous Year Question Papers. I Sem Methods and Techniques for Business Decisions.

Question Papers NovDec 2015. Download GST Previous Year paper for GST of GST subjects in pdf or jpg format below. I Sem Tamil Part 1 I Sem Kannada.

OPERATION MANAGEMENT NOVEMBER 2015. OFFICE AUTOMATION MARCH 2012. D What is Reverse Charge.

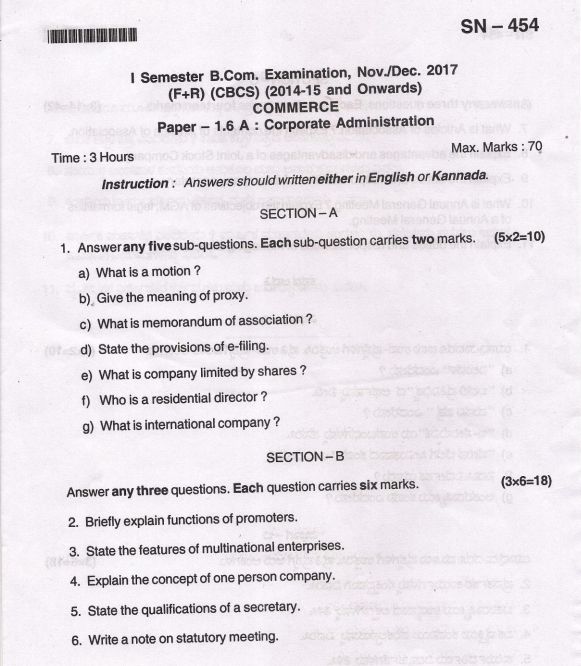

Examination December - CBCS FR 2017-18 and Onwards COMMERCE 56 Elective Paper-Il. Download the Calicut University BCom Previous year question papers of All subjects from below. BCom is the second most popular undergraduate course in the Commerce branch.

B Who is a Non-Resident Person. The answers are also given for your reference. I Sem Sanskrit - 1.

A To consolidate multiple indirect tax levies into single tax b Overcoming limitation of existing indirect tax structure. The main objective of GST implementation is. Our website provides solved previous year question paper for Goods and Service Tax from 2017 to 2018.

GST Previous Question Papers - Year Wise. Students who are Searching Bangalore University BCom Question Papers can find Complete List of Bangalore University Bachelor of Commerce BCom 1st 2nd and 3rd-year Question Papers. C What is Principal Supply.

Kindly refer and try to attempt and I wish to successes in your GSTP Exam. Both the transactions are intra state and show the GST Tax ledgers. INCOME TAX GST-MARCH 2020.

Write a note on Indian GST Model. 10000 worth of goods are purchased GST tax rate 5. Goods and Services Tax.

In second invoice two purchases of Rs 5000 worth goods GST rate 5 and another Rs 5000 GST 18. You can check the lectures available by clicking the course contents. INCOME TAX AND GST.

What is the value in GST invoices when Rs. I Sem Hindi - 1. I Sem Marketing and Services Management.

General InformaticsGI Business Regulatory Framework. The company includes GST to the cost of goods and a buyer who purchases the goods pays the cost price with the GST. A sold goods to Mr.

I Sem Corporate Administration. SECTION-B Answer any three questions. Each question carries six marks.

GST is levied in India on the basis of Principle. F What is First Return. Of Printed Pages GN-348 8 103483 2019 V Semester B.

I Sem Indian Financial System. Given below are important MCQs on GST to analyse your understanding of the topic. A is charging packing charges.

This course includes almost all the chapters covered by various universities at the UG level. However students are advised to check the chapters available in this course with concern university syllabus. Both the transactions are intra state and show the GST Tax ledgers.

Download GST Previous Year paper for GST for 2020 2019 2018 2017 2016 2015 2014 years in pdf or jpg format below. A Origin b Destination c Either a or b d Both a or b 3. I Sem English - 1.

I Sem Financial Accounting. Download GST Study Material. The NACIN announced GST practitioner exam will be conducted on 1462019.

10000 worth of goods are purchased GST tax rate 5.

2018 Mdu Bcom Tpp 1st Sem Goods Service Tax Question Paper Mduquestionpaper Youtube

Financial Accounting Paper 5 2016 2017 B Com Accounting And Finance Baf Semester 5 Tybaf Question Paper With Pdf Download Shaalaa Com

Bangalore University Old Question Papers

Gst Goods And Service Tax Model Papers Naganjaneyulu

Direct And Indirect Taxation Paper 1 2018 2019 B Com General Semester 5 Tybcom Set 1 Question Paper With Pdf Download Shaalaa Com

Bu B Com Business Taxation Ii May 2016 Question Paper University Question Papers

Direct And Indirect Taxation 2016 2017 Bcom Idol Correspondence 3rd Year Tybcom R 2013 Question Paper With Pdf Download Shaalaa Com

B Com 6th Semester Income Tax Law And Practice Previous Year Question Papers Studynotes

Gst Goods And Service Tax Model Papers Naganjaneyulu

Mysore University Bcom Old Question Papers 2021 2022 Studychacha

Bu B Com Business Taxation Ii May 2016 Question Paper University Question Papers

B Com 6th Sem Theory And Practice Of Gst 2020 Question Paper Osmania University Youtube

Gst Question Paper For Bcom 3rd Year Question Paper Of Gst Bcom 3rd Year Question Paper Of Gst Youtube

Bu B Com Business Taxation Ii May 2016 Question Paper University Question Papers

Bu B Com Business Taxation Ii May 2016 Question Paper University Question Papers

Managerial Accounting 6th Sem B Com 2021 Question Paper Osmania University Youtube

Calicut University Bcom 6th Semester Income Tax And Gst Previous Year Question Papers Youtube

Taxation 5 Direct Taxes 2 2015 2016 B Com Accounting And Finance Baf Semester 6 Tybaf Question Paper With Pdf Download Shaalaa Com

Post a Comment for "Gst Question Paper For Bcom"