Example Of W2 And 1040

Employees use Form W-2 to complete their individual income tax returns. See Box 1 on your W-2.

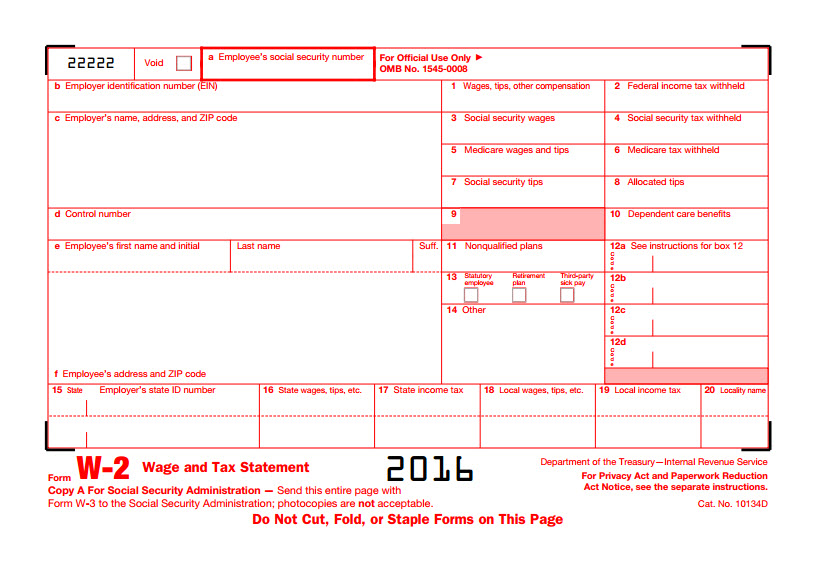

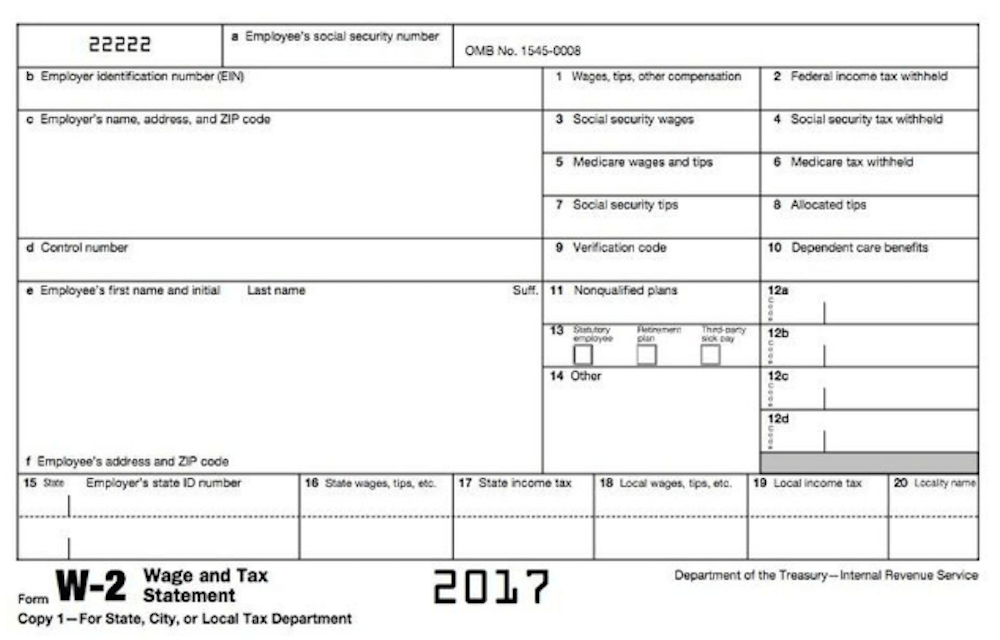

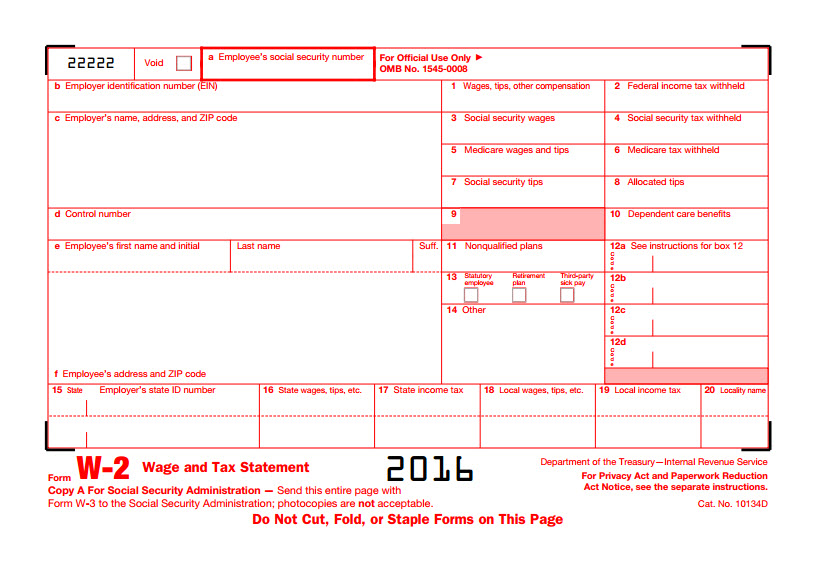

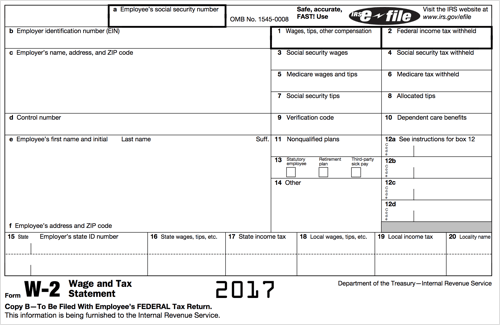

Wage Tax Statement Form W 2 What Is It Do You Need It

Therefore this form has a major impact on either how much money youll owe or receive back.

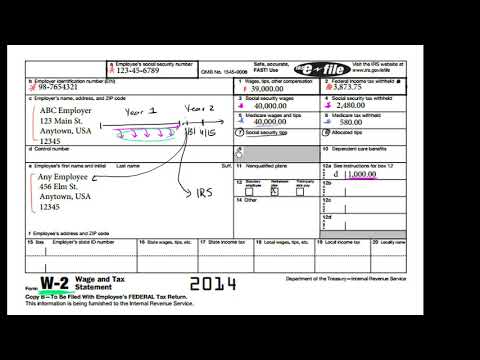

Example of w2 and 1040. Form W-2 reports earnings from employment and taxes withheld from those earnings to both an employee and the IRS. Wage and Tax Statement. So lets talk a little bit about w-2 forms which are super important forms when you are filling out your taxes and to get a sense of what filling out your taxes are even about lets just draw a little bit of a timeline and Ill draw it right here on the w-2 form so lets say that is year 1 so year 1 and then of course we go into year 2 year 2 and lets say you are working at a BC employer for.

Are taxable and need to be reported on the taxpayers individual income tax return. The full name the IRS gives to Form 1040 is Form 1040. A 1040 transcript is a summary of the items included in your tax return such as your reported income status and dependents.

The business return sample is for 1120S but 1065s and other 1120s will have similar information. Are reported on Form W-2 Wage and Tax Statement. Enter your salary exactly as it appears on your W-2.

Employees use this information to prepare their annual tax returns. Using Your W-2 to File Your 1040EZ. Form 1040 instructions for small business owners and the self-employed.

If you go to your companys online payment or HR system there is normally a tab for your tax forms including your W-2. Copy BTo Be Filed With Employees FEDERAL Tax Return. Restricted stock units RSUs are company shares granted to employees.

Party sick pay to individual employees on Form W-2 Wage and Tax Statement 2 filing with SSA copies of the Forms W-2 together with Form W-3 Transmittal of Wage and Tax Statements that are not third-party sick pay recaps and 3 reporting such payments to the IRS on Form 941 Employers QUARTERLY Federal Tax Return. As mentioned above the law requires employers to send your W-2 by the end of January. Enter wages salary and tips.

This is a taxable event with implications that can affect withholding from your paychecks and your tax liability when you file your tax return. Use Form W-2 C to correct errors on Form W-2 W-2AS W-2CM W-2GU W-2VI or W-2c filed with the Social Security Administration SSA. Its also common for your employer to make your W-2 available online.

RSUs that appear on Form W-2 indicate that shares have been delivered to you which usually happens after vesting. Employers report federal income tax withheld Social Security tax withheld and Medicare tax withheld on Form W-2. Employers typically send out W-2 forms through the mail.

In fact the Internal Revenue Services Form 1040 instructions PDF document is over 100. A W-2 reports. Also use Form W-2 C to provide corrected Form W-2 W-2AS W-2CM W-2GU W-2VI or W-2c to employees.

Moving on to the Payments section lets suppose Johns original return had withholding of 2100 shown on Form 1040 Line 16 and the new W-2 shows withholding of 300 in Box 2. Form W-2 also known as the Wage and Tax Statement is the document an employer is required to send to each employee and the Internal Revenue Service IRS at the end of the year. A W-2 transcript summarizes the wage information submitted by your employer for example your employment wages retirement contributions and tax withholding.

Boxes 1 3 and 5 should include 200 the amount in excess of the nontaxable assistance and applicable taxes should be withheld on that amount. Use your W-2 to enter your wages salary and tips on your 1040EZ. Copy BTo Be Filed With Employees FEDERAL Tax Return.

Emilys Form W-2 should report 5200 of dependent care assistance in box 10 4500 FSA plus 700 on-site dependent care. If you need to know employerspayers name earnings from a. While the 1040 is one of the most common tax forms if you ask almost any tax-paying American youll likely see a glimmer of recognition its also deceptively complex.

Understanding Taxes - Simulation. On Form 1040X Line 12 in the Payments section John would enter 2100 in Column A and 300 in Column B. Wage and Tax Statement.

Available for up to 10 tax years. You can contact the IRS at 800-829-1040 if an employer wont or doesnt give you a Form W-2 by mid-February of the new year. Department of the TreasuryInternal Revenue Service.

This information is being furnished to the Internal Revenue Service. Form 1040 Defined. Individual Income Tax Return For your 2019 taxes which you file in 2020 you will need to use the Form 1040 to report your income.

Column C would show 2100 300 2400. W-2 Transcript pdf W-2 1099 and all other wage and income transcripts will look similar to this.

How To Read Your Form W 2 Taxgirl

Understanding Your W 2 Controller S Office

Calculate Adjusted Gross Income Agi Using W2 Tax Return Excel124

Intro To The W 2 Video Tax Forms Khan Academy

2015 W2 Fillable Form Understanding Your Tax Forms The W 2 Tax Forms W2 Forms Tax Time

W 2 User Interface W 2 Wage And Tax Statement Data Is Entered Onto Windows That Resemble The Actual Forms Imports Employee Informa Irs Forms W2 Forms Irs

Account Abilitys 1099 Div User Interface Dividends And Distributions Data Is Entered Onto Windows That Resemble The Act Irs Forms Fillable Forms Accounting

1099 K Software E File Tin Matching Tax Forms Envelopes Irs Forms Tax Forms Money Template

W2 Forms Google Search Tax Forms W2 Forms Tax Time

Deciphering The W 2 A Handy Guide A Better Way To Blog Paymaster

2015 W2 Fillable Form Fillable Form 8959 Additional Medicare Tax 2015 Fillable Forms Power Of Attorney Form W2 Forms

Form 1040 Sr U S Tax Return For Seniors Tax Forms Irs Tax Forms Ways To Get Money

How To Fill Out A W 2 Tax Form For Employees Smartasset

Irs Approved Blank W2 G Gambling Winnings Forms File This Form To Report Gambling Winnings And Any Federal Tax Forms The Secret Book Card Templates Printable

Form W2 2013 Fillable 2013 W2 Form Pdf Fillable Templates Resume Examples Tax Forms Income Tax Irs Tax Forms

Fillable W2 Form 2014 Fillable Form 4852 Rev September 2014 Printable Pdf Printable Job Applications Job Application Template Form

Understanding Form W 2 A Guide To The Wage Tax Statement Ageras

So You Have Stock Compensation And Your Form W 2 Just Arrived Now What The Mystockoptions Blog

W 9 Form 2016 Pdf Fillable Brilliant Free W2 Forms From Irs Throughout Free W 9 Form In 2021 Tax Forms Irs Forms Employee Tax Forms

Post a Comment for "Example Of W2 And 1040"