Provide Three Example Journal Entries With A Description Of The Adjustment

1Prepaid expenses insurance is one of them Companys insurance for a year is 1800 paid on Jan 1 st The monthly insurance cost is 180012 months 150 per month. Enter the debit and credit amounts.

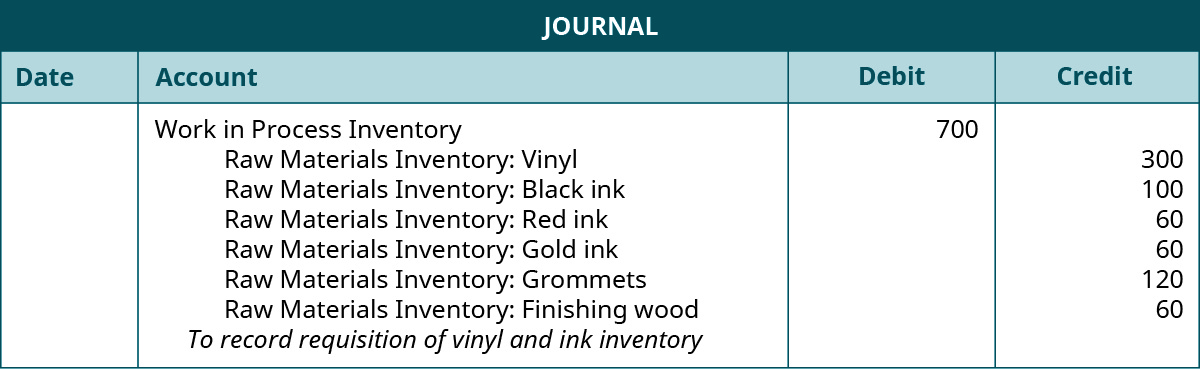

Prepare Journal Entries For A Job Order Cost System Principles Of Accounting Volume 2 Managerial Accounting

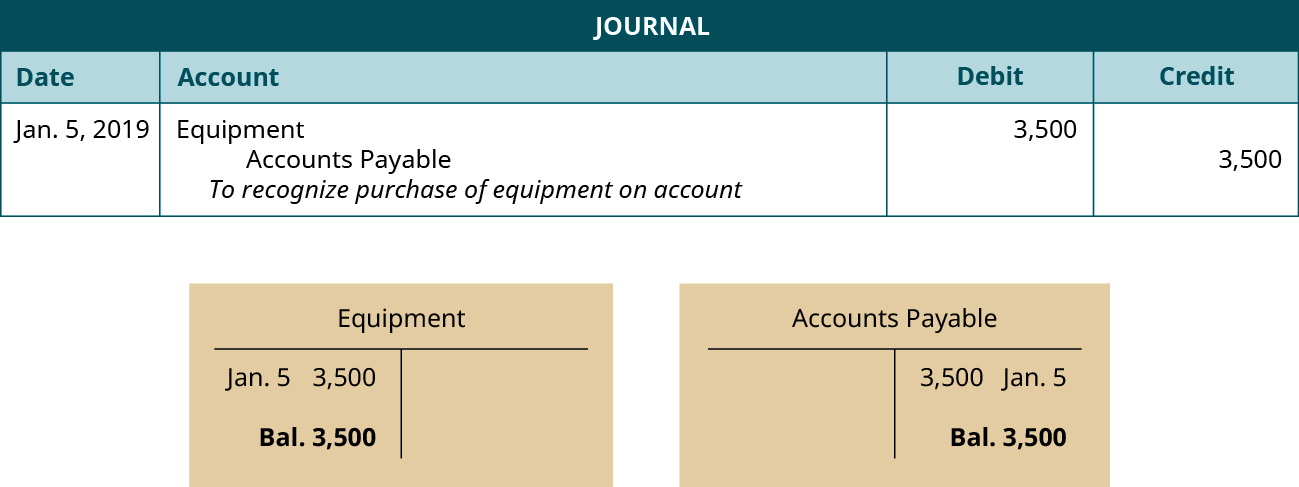

Increase in an expense and decrease in an asset.

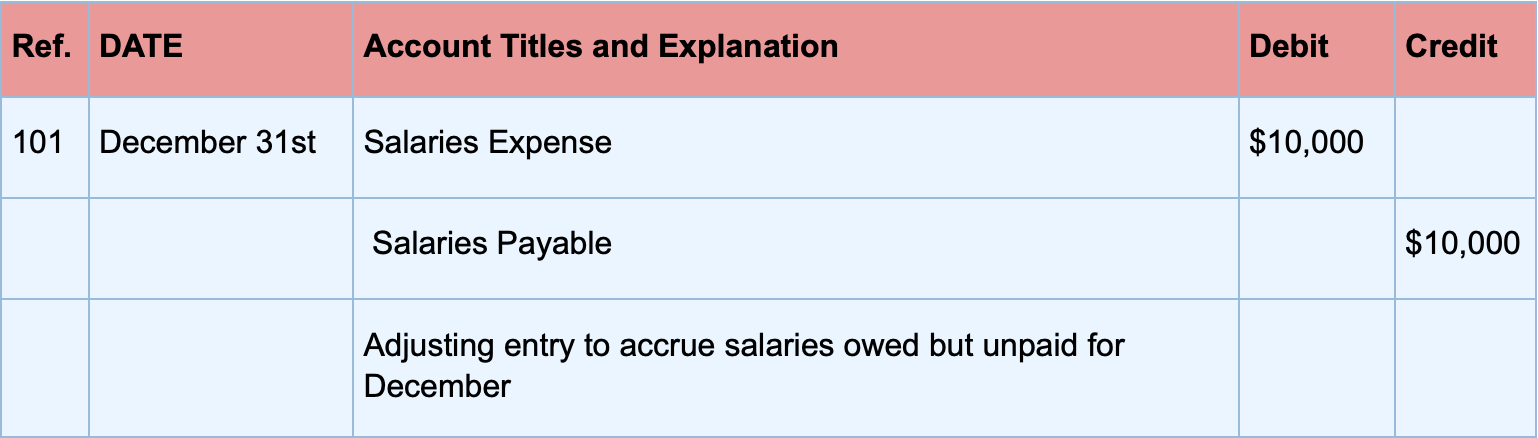

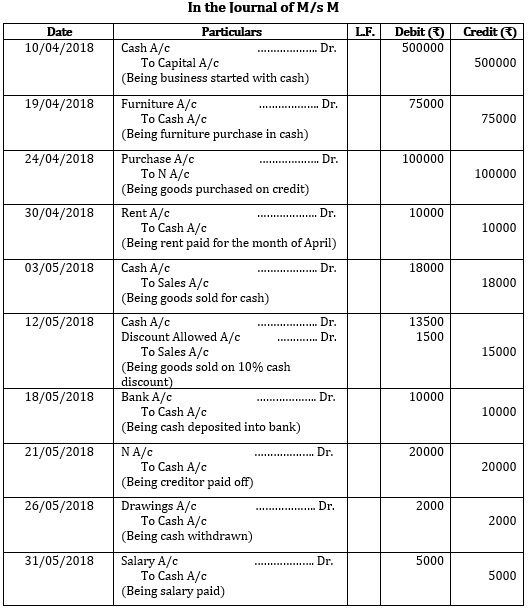

Provide three example journal entries with a description of the adjustment. The post Provide three example journal entries with a description of the adjustment. Edit the journal header information if the status is not Final. Adjusting Entries Example 1 Accrued but Unpaid Expenses.

Give an example of an adjusting journal entry for each of the following transactions. What are the various internal control procedures with respect to cash receipts and payments. Edit and create journal lines including accounts.

Experts are tested by Chegg as specialists in their subject area. At the end of January the total value of the services provided to Mr. The Moon company receives 180000 cash from Mr.

We review their content and use your feedback to keep the quality high. Provide three correct responses. A typical example is credit sales.

Who are the experts. Y a client of the company on January 01 2015. Provide three example journal entries with a description of the adjustment.

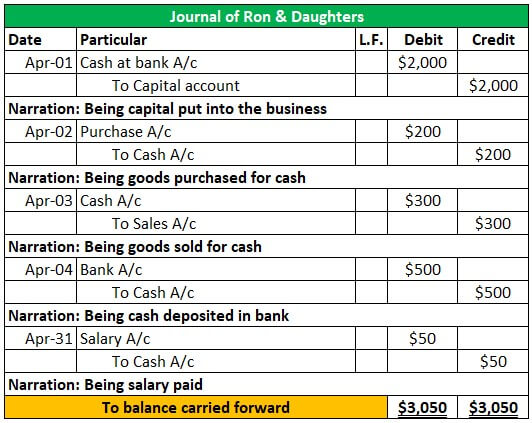

Provide three example journal entries with a description of the adjustment. Enter the accounting class. In each case the bank reconciliation journal entries show the debit and credit account together with a brief narrative.

Why do journal entries need to be prepared after completing the bank reconciliation. Date Account Debit Credit Aug 1 Rent expense 1500 Cash 1500 To record payment of the electric bill by paid by check T Month Account Debit Credit Aug 20 Cash 400 I nterest Revenue 400 To record interest earned on the bank balance. If accounts are adjusted at the end of each month the relevant journal entries are given below.

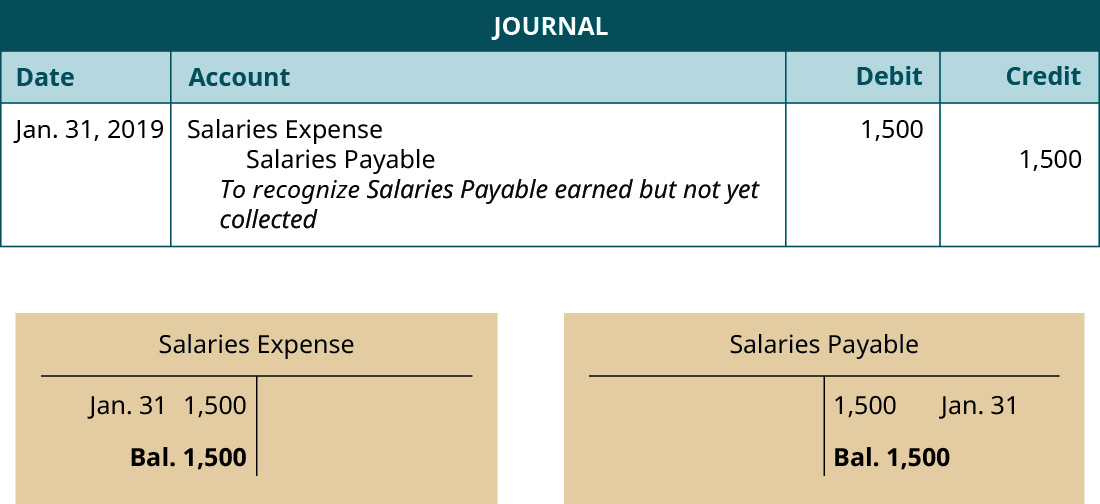

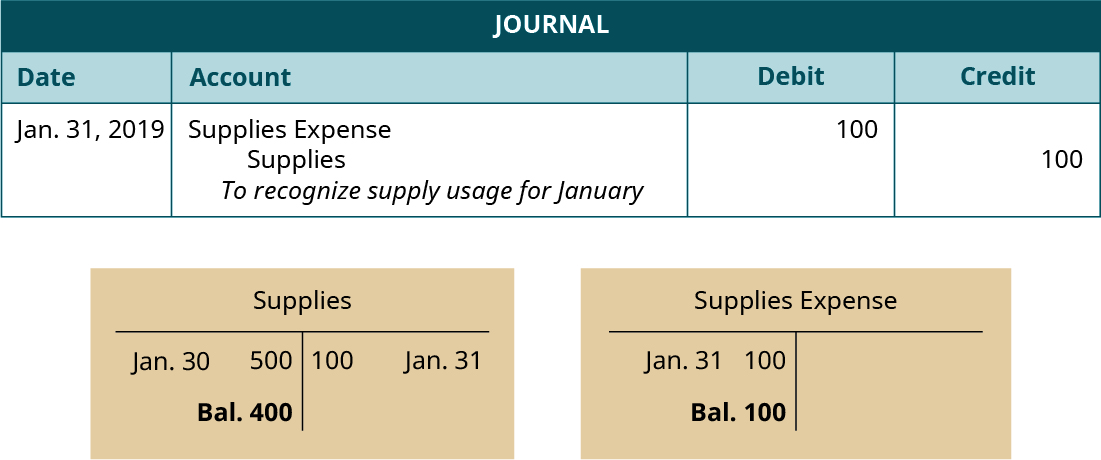

The adjustment journal entry required on January 31 st is shown below. When editing a subledger journal adjustment you can perform the following tasks. The bank reconciliation journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting relating to bank reconciliation adjustments.

Entry on January 01 when advance payment is received. Jeff an owner of a small furniture manufacturing company named Azon offers A-Z varieties of furniture. Provide three example journal entries with a description of the adjustment.

Adjusting Journal Entries Examples. When preparing a bank reconciliation what are the different adjustments that affect the book and bank side. Equal growth of an expense and a liability.

The transactions which are recorded using adjusting entries are not spontaneous but are spread over. Top 3 Examples of Adjusting Entries. Types of Adjusting Journal Entries.

Below are the examples of Adjusting Journal Entries. An accrued revenue is the revenue that has been earned goods or services have been delivered while the cash has neither been received nor recorded. What is the difference between the direct write-off method and the allowance method for receivables.

Adjusting entries are journal entries recorded at the end of an accounting period to adjust income and expense accounts so that they comply with the accrual concept of accounting. Their main purpose is to match incomes and expenses to appropriate accounting periods. Equal growth of an asset and revenue.

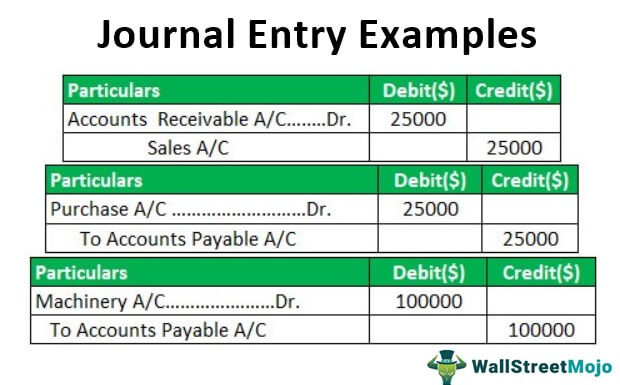

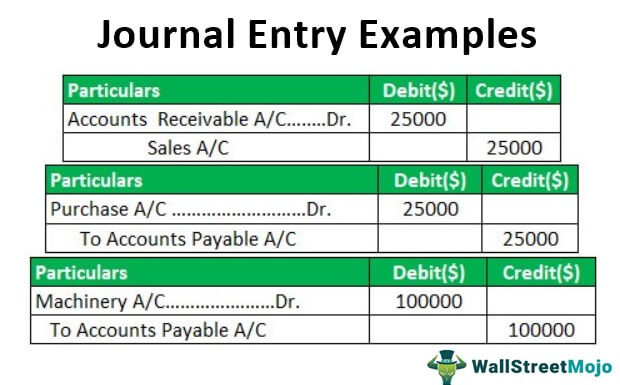

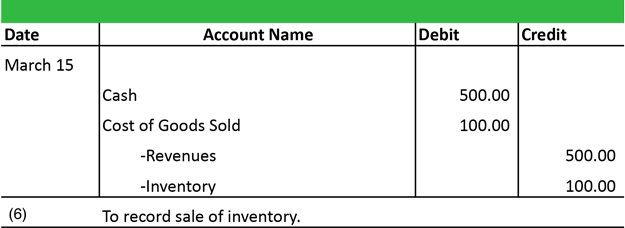

Here are the examples for each category of the journal entries. Provide three example journal entries with a description of Question. Earning of revenue that was previously recorded as unearned revenue.

Editing a Subledger Journal Adjustment. Adjusting entries are journal entries made at the end of an accounting cycle to update certain revenue and expense accounts and to make sure you comply with the matching principle. Azon ends its accounting year on June 30.

The revenue is recognized through an accrued revenue account and a receivable account.

What Are Adjusting Entries Definition Types And Examples

Rules For Journal Entries Step By Step With Examples

The Basic Accounting Journal Entries

Adjusting Journal Entry Overview Types Examples

Journal Entry Example Top 10 Accounting Journal Entries Examples

Bookkeeping Adjusting Entries Reversing Entries Accountingcoach

Online Accounting Accounting Entry Accounting Journal Entries

Accounting Entry Accounting Journal Accounting Entries

Journal Entry Example Top 10 Accounting Journal Entries Examples

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Adjusting Entries Meaning Types Importance And More

Acg2021 Ch 4 Assignment Flashcards Quizlet

What Are Journal Entries Definition Features Rules Specimen Process Types Puropose Limitations Example The Investors Book

Use Journal Entries To Record Transactions And Post To T Accounts Principles Of Accounting Volume 1 Financial Accounting

Lessee Accounting For Governments An In Depth Look Journal Of Accountancy

Journal Entries Examples Format How To Explanation

Adjusting Journal Entry Overview Types Examples

Record And Post The Common Types Of Adjusting Entries Principles Of Accounting Volume 1 Financial Accounting

Payroll Journal Entries For Wages Accountingcoach

Post a Comment for "Provide Three Example Journal Entries With A Description Of The Adjustment"