Quick Ratio Example Balance Sheet

Total liabilities total assets debt to asset ratio Lets do an example. Divide your current liabilities by your current assets to get your current ratio.

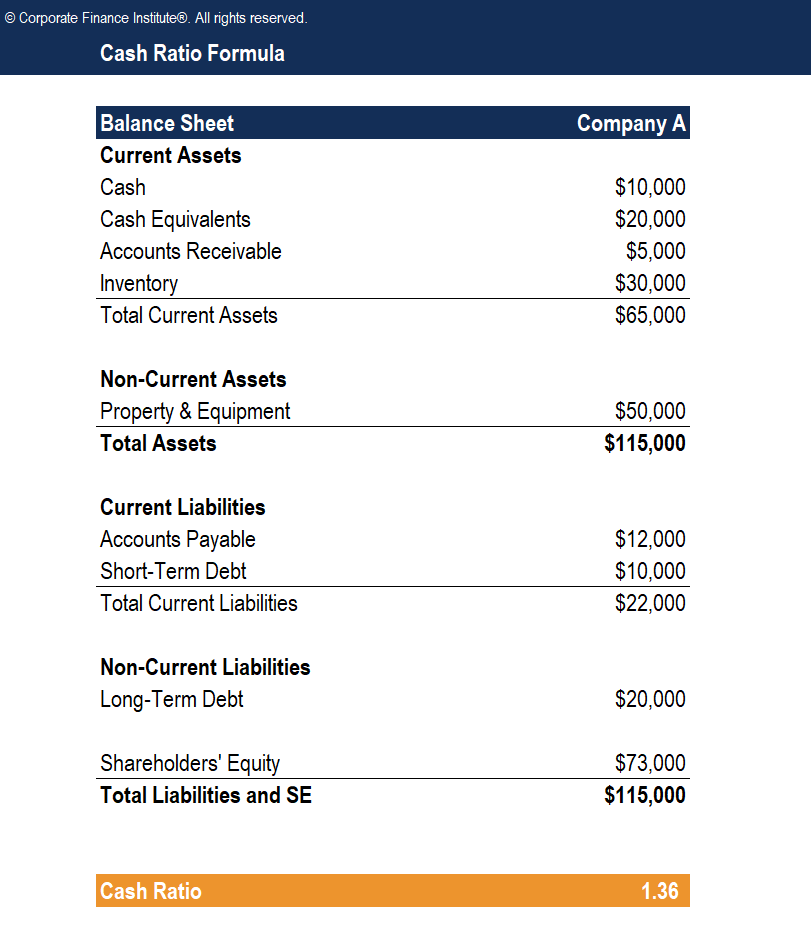

Cash Ratio Template Download Free Excel Template

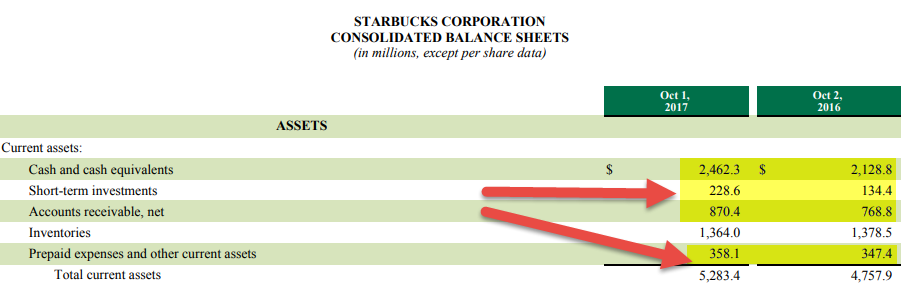

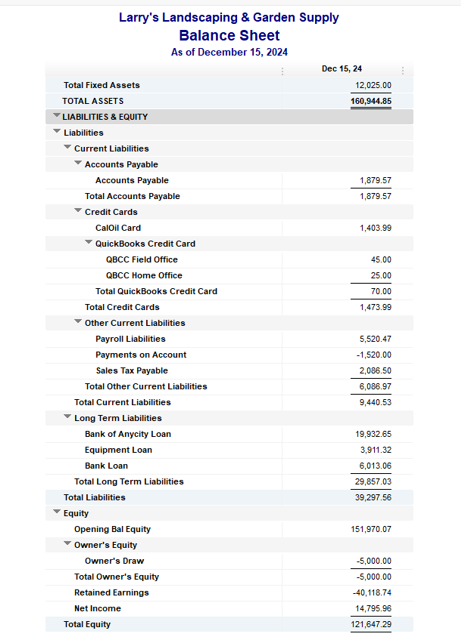

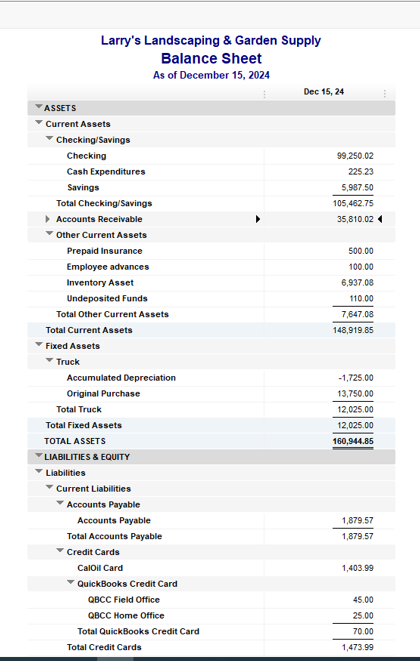

A lender would need to compute the quick ratio and ask for the balance sheet from the store owner.

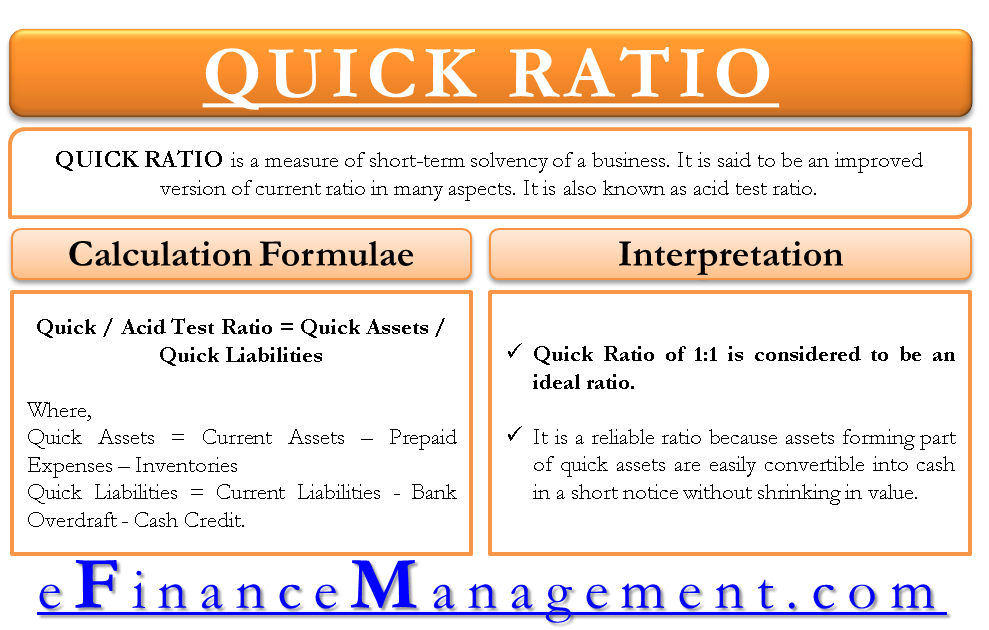

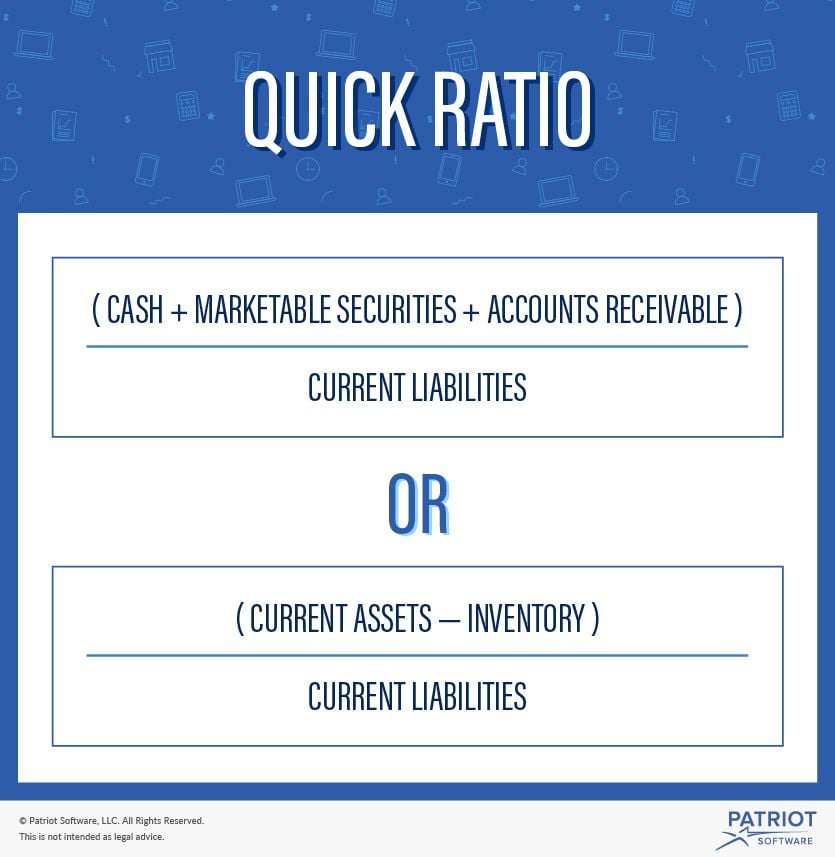

Quick ratio example balance sheet. The ratio is also known by the name acid test ratio. Cash and cash equivalents marketable securities and short-term receivables. The Quick Ratio Formula.

Current ratio example Say you have 30000 in current assets and 15000 in current liabilities. While such numbers-based ratios offer insight into the. Caroles balance sheet included the following accounts.

The bank can compute Caroles quick ratio. The formula for quick ratio is. Quick Ratio A similarly informative balance sheet metric is a companys quick ratio.

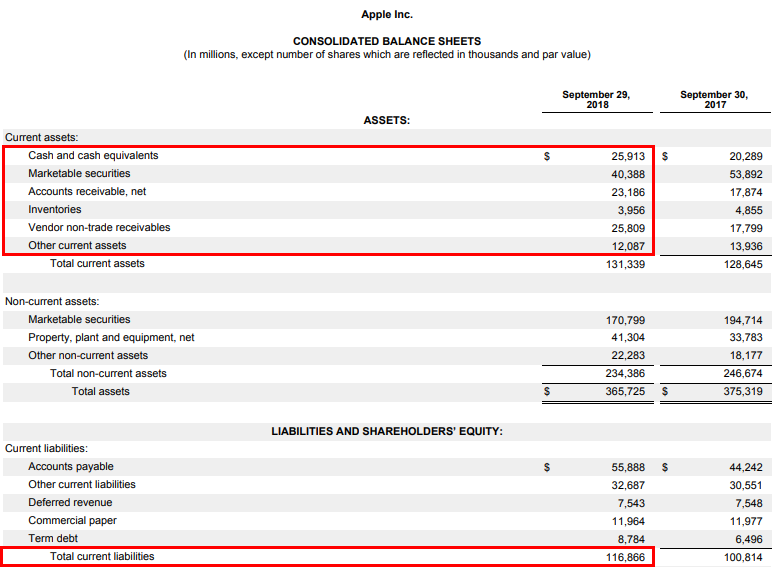

In fact the name quick ratio comes from the underlying idea that the ratio takes into account only those assets that can be quickly liquidated. Quick Ratio 28392-10396 12355 146. Balance sheet ratios evaluate a companys financial performance.

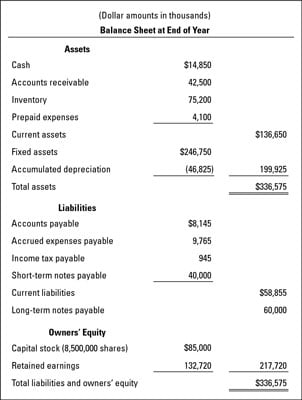

Plug the corresponding values into the formula and compute. Liquidity solvency and profitability. For example lets assume a company has.

Quick ratio 10000 1000 5000 15000 16000 15000. 14138277 944053 1498. You have 10000 in assets and 4000 liabilities debt.

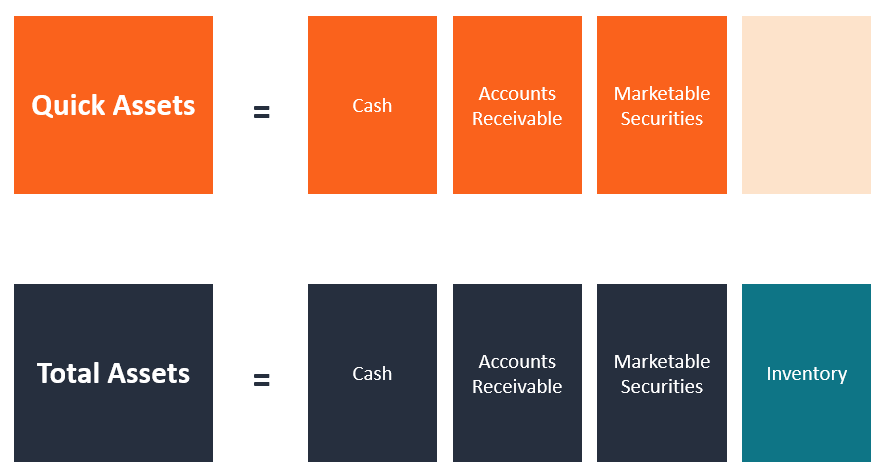

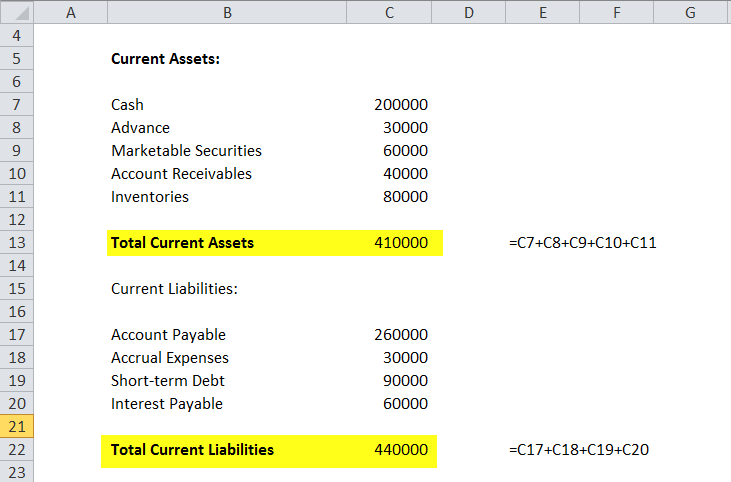

Calculations of Working Capital Current Ratio and Quick Ratio. Solvency ratios show the ability to pay off debts. Quick Ratio Cash equivalents marketable securities accounts receivable Current liabilities.

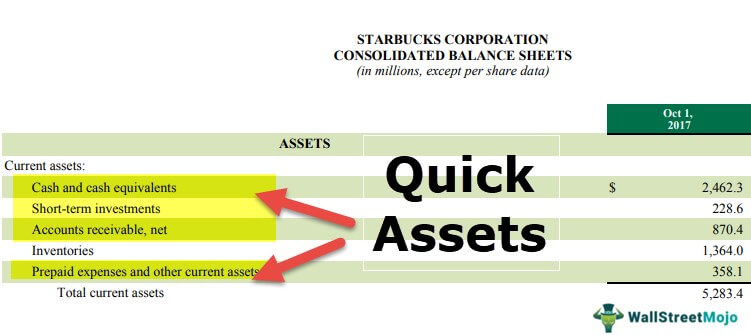

Use the amounts in Example Corporations balance sheet above to calculate the following financial ratios. Quick assets refer to the more liquid types of current assets which include. Liquidity ratios show the ability to turn assets into cash quickly.

Hence the quick ratio can also be computed as. The primary examples of such quick assets include cash marketable securities and accounts receivables. How to calculate your debt to asset ratio To calculate your debt to asset ratio look at your balance sheet and divide your total liabilities by your total assets.

Quick ratio Quick assets Current liabilities. There are three types of ratios derived from the balance sheet. Double check your numbers to ensure that only current liquid assets and.

Inventories and prepayments are not included. Previous years quick ratio was 14 and the industry average is 17. 14 rows Current Ratio 28392 12355 230.

Working capital as of December 31 2020. For instance a quick ratio of 15 indicates that a company has 150 of liquid assets available to cover each 1 of its current liabilities. Current ratio as of December 31 2020.

Balance sheet ratio indicates relationship between two items of balance sheet or analysis of balance sheet items to interpret companys results on quantitative basis and following balance sheet ratios are financial ratio which include debt to equity ratio liquidity ratios which include cash ratio current ratio quick ratio. The balance sheet is illustrated below. Or alternatively Quick Ratio Current Assets Inventory Prepaid expenses Current Liabilities.

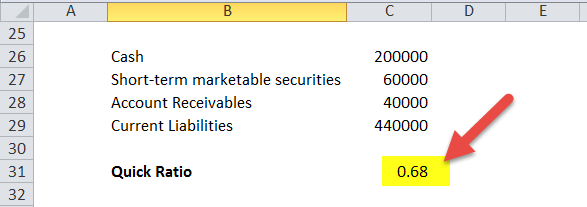

Current Ratio 30000 15000. Quick ratio formula Cash Short-term marketable securities Acs Receivable Current Liabilities. Quick Ratio Current Assets Inventory Current Liabilities When calculating the ratio the first thing you need to do is look for each component in the current liabilities and current assets section of the balance sheet.

The bank asks Carole for a detailed balance sheet so it can compute the quick ratio. Calculation of acid test ratio formula. Quick ratio Cash and cash equivalents Marketable securities Short-term receivables Current liabilities or.

Example of Quick Ratio If a companys cash and cash equivalents marketable securities accounts receivable adds up to 1000000 and the amount of the companys current liabilities is 1200000 its quick ratio is 083 to 1 10000001200000 083. This ratio is a bit more conservative than the current ratio as it removes inventories from the calculation. 944053 Step 3 You can now calculate the quick ratio.

200000 60000 40000 440000 300000 440000 068.

Quick Ratio Formula Meaning Example Interpretation

Quick Ratio Meaning Formula Example And Analysis Accounting Sheet

Quick Assets Definition Formula List Calculation Examples

Quick Assets Definition Formula List Calculation Examples

Quick Assets Overview How To Calculate Example

Quick Ratio Formula Step By Step Calculation With Examples

Quick Ratio In Financial Analysis And Modeling Magnimetrics

Quick Ratio An Acid Test Of Short Term Solvency Of A Business

Quick Ratio In Financial Analysis And Modeling Magnimetrics

4 Useful Balance Sheet Ratios That Every Business Owner Needs To Know Gusto

Quick Ratio Or Acid Test Ratio Top Examples With Excel Template

How To Calculate The Quick Ratio Examples The Blueprint

Quick Ratio Formula Step By Step Calculation With Examples

How To Calculate The Quick Ratio Examples The Blueprint

Quick Ratio Can You Pay Your Small Business S Liabilities

Quick Ratio Formula Meaning Example Interpretation

Calculating The Acid Test Ratio For A Business Dummies

Acid Test Ratio Or Quick Ratio Definition Formula Example Liquidity Analysis Industry Average Calculator

Post a Comment for "Quick Ratio Example Balance Sheet"